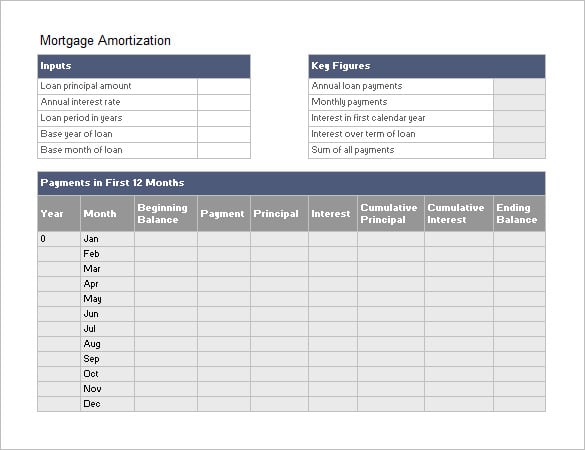

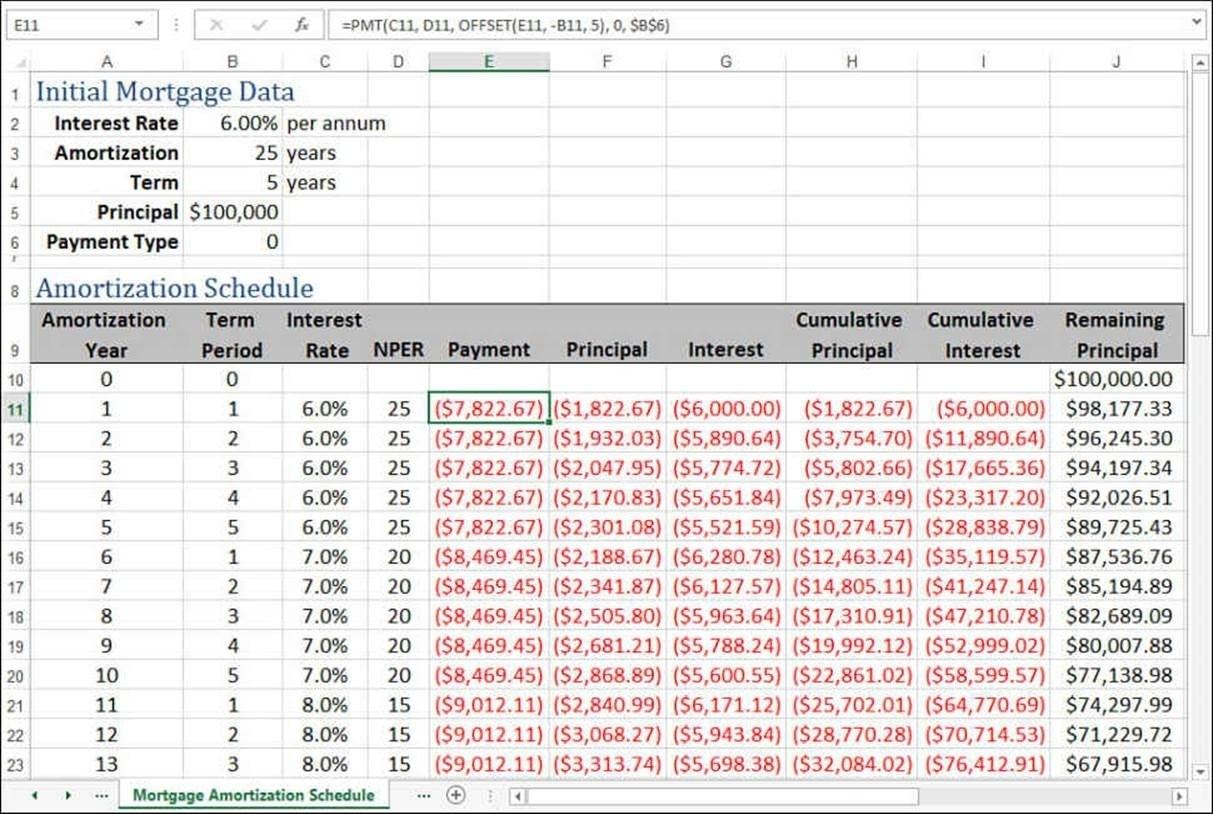

Note that towards the beginning of your loan, more of your money may be paying for interest rather than the principal itself.Įxtra Payments may be made towards the principal, and then entered in the Extra Payment column on the appropriate date. A summary can be found to the right, and below you will find a full schedule of the dates and amounts of each payment, broken down into the amounts going towards Interest and Principal. Once you have filled in all of this information, the loan amortization calculator will calculate your payments over the full term of your loan. If for some reason you do not wish to round to the nearest cent, you may disable this feature. Rounding is enabled by default to round all values to the nearest cent, which most lenders will also do.

By default, this is set to automatically update to match your payment frequency, so you only need to change it manually if the two are different. Select this from the drop-down menu (monthly is common).Ĭompound Frequency is how often the interest is compounded. Payment Frequency is how often you plan to make payments.

If you are calculating an existing loan, enter the date of your next payment.

Decimals may be used as long as they divide evenly into your payment frequency.įirst Payment Date is the date on which you will make the first payment on the loan. If you are calculating a loan that is already partially paid off, enter the remaining time on the loan. Term is the number of years, starting from today, over which you plan to pay back the loan. If you're calculating a loan that is already partially paid off, enter the remaining balance of your loan.Īnnual Interest Rate, aka Annual Percentage Rate (APR), is the interest rate designated by the lender. Loan Amount is the entire principal of the loan. Fill in the blue-bordered cells at the top of the spreadsheet with the terms of your loan:

0 kommentar(er)

0 kommentar(er)